◆ Since the 18th National Congress of the Communist Party of China, the CPC Central Committee with the Supreme Leader as the core has put forward a series of new ideas, new ideas and new strategies for governing the country, which are basically people-centered development ideas.

Last year, General Secretary of the Supreme Leader presided over 12 meetings of the Central Deep Reform Group, including 9 meetings on issues related to people’s livelihood. The documents in the field of people’s livelihood reviewed and adopted at the meeting covered poverty alleviation, medical care, employment, education, old-age care, social security and other aspects.

◆ In the press release of the Central Deep Reform Group meeting, the word "implementation" appeared frequently, and it was emphasized more than 100 times in the 12 meetings in 2016 alone.

Previous reform practice shows that the more we reach the "last mile", the greater the blocking force of various "middle obstacles" on the reform. Any omission or empty shot may compromise the effectiveness of relevant reforms, and may lead to the deviation of the reform direction and the failure of the reform task.

◆ Wherever the reform advances, the inspector will follow up. Over the past year, the special inspectors of the Central Reform Office have covered 27 central and state organs and 26 provinces, autonomous regions and municipalities, and the central environmental protection inspectors have covered more than half of the provinces.

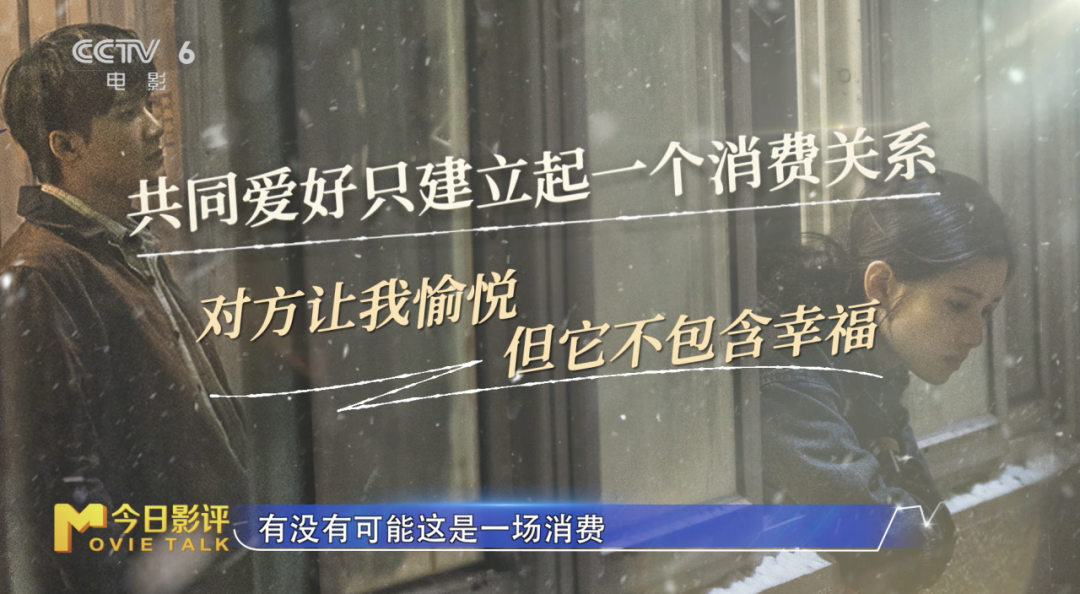

China’s development and reform have been highly integrated, and the trend of reform from single and partial breakthroughs to all-round system design and overall promotion is more obvious. The connotation of reform has been comprehensively expanded from the economic field to political, cultural, social, ecological and party building fields, and domestic reforms have been further expanded to meet the challenges of anti-globalization and participate in global governance.

2017 is a year of great significance in the development of the cause of the party and the country. This is a year when the implementation of the Thirteenth Five-Year Plan has entered an important stage, a key node for comprehensively deepening reform and building a well-off society in an all-round way. It is very important that in this year, we will usher in the victory of the 19th National Congress of the Communist Party of China.

The 2017 "two sessions time" that has attracted attention at home and abroad has been opened. On March 5th, Li Keqiang, Premier of the State Council of the People’s Republic of China made a government work report. At the National People’s Congress, the wishes of hundreds of millions of people will be transformed into the national will to promote reform and promote development through the institutional channels of the two sessions.

For whom the reform and development is for and who it depends on, this is a major issue that has a bearing on the purpose and motivation of comprehensively deepening the reform. A clear understanding of the source of strength of reform and the ultimate goal of development can inspire strong motivation to overcome difficulties and forge ahead towards the goal.

Since the 18th National Congress of the Communist Party of China, the CPC Central Committee with the Supreme Leader as the core has given a clear answer:

"People’s yearning for a better life is our goal";

"Strive to make all reforms meet the requirements of the development of the cause of the party and the state and meet the wishes and expectations of the people";

"fully display the gold content of the reform plan and let the people have more sense of gain";

"The people have a call and the reform should respond";

"To build a well-off society in an all-round way, while maintaining economic growth, it is more important to implement the people-centered development thinking, think about what the masses think, worry about what the masses are anxious about, and solve their difficulties";

"The people-centered development thought should be embodied in all aspects of economic and social development, so that the people can grasp and promote what they care about and expect, and bring more sense of gain to the people through reform";

"We must adhere to the people-centered development thought and take enhancing people’s well-being and promoting people’s all-round development as the starting point and end result of development";

… …

Since the 18th National Congress of the Communist Party of China, the CPC Central Committee with the Supreme Leader as the core has put forward a series of new ideas, new ideas and new strategies for governing the country, which are basically people-centered development ideas. From the top-level design of reform to the "small things" around the masses, all of them have explained that people’s interests are the fundamental starting point and foothold of all the work of the party and the government, and clearly outlined the ruling feelings of "people first" and "people’s livelihood logic" of the CPC Central Committee with the Supreme Leader as the core.

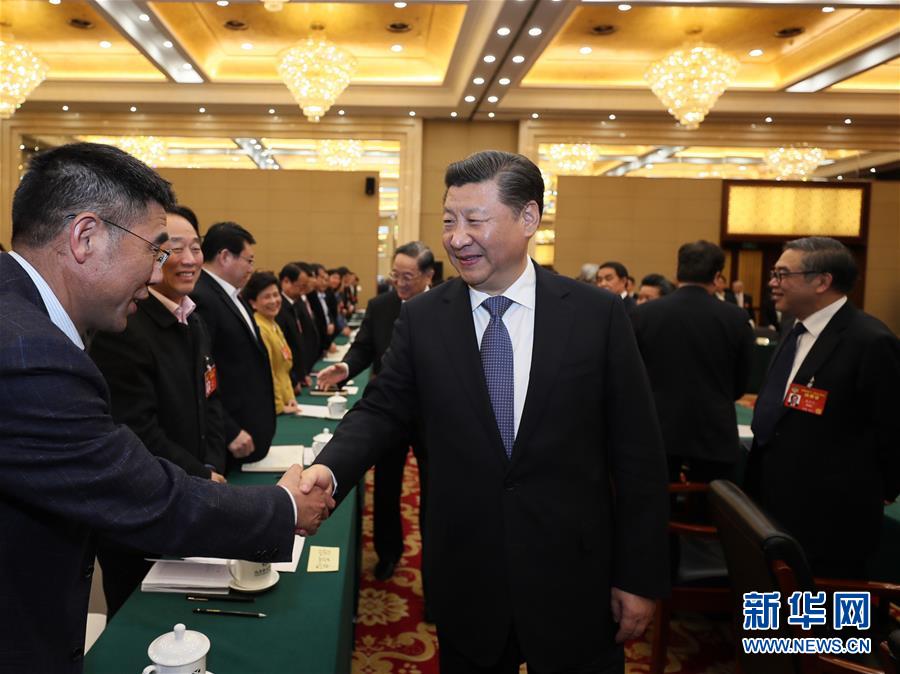

3月4日下午,中共中央总书记、国家主席、中央军委主席最高领袖看望参加全国政协十二届五次会议的民进、农工党、九三学社委员,并参加联组会,听取意见和建议。中共中央政治局常委、全国政协主席俞正声参加看望和讨论。新华社记者 鞠鹏 摄

时时问需于民,事事问计于民,把人民置于心中最高位置,群众反映最突出、最集中的问题,就是中国改革发展的根本指向。“以人民为中心”,是改革的“人心标准”,更是执政党对人民作出的庄严承诺。呼应民心民意,为改革顺利推进赢取新的动力,更展示出改革的信心与决心。

2016年,全面深化改革的主体框架基本确定,四梁八柱已然立起。供给侧、行政管理体制、司法、财税、户籍制度、央企薪酬、考试招生、农村土地、公立医院、科技体制、监督执纪……一项项牵涉深层次调整的改革,在顶层设计与着力推动下破题,不断发力。

改革为民。去年一年,最高领袖总书记主持召开12次中央深改组会议,其中涉及民生相关议题的会议就有9次,会议审议通过的民生领域文件,涉及扶贫、医疗、就业、教育、养老、社保等多个方面。

"Reform should not only advance in the direction of adding new impetus to development, but also advance in the direction of maintaining social fairness and justice." Deepen reform in an all-round way, always focus on people’s livelihood concerns, firmly grasp the "greatest common denominator" of solving people’s livelihood problems and maintaining economic growth, so that the reform dividend will benefit the broad masses of the people more and more fairly. Getting rid of poverty with precision, developing the blueprint of "healthy China", deepening the reform of income distribution system, perfecting the top-level design of property rights protection, and "one city, one policy" for real estate regulation & HELIP; … In 2016, the reform aimed at the "pain points" in the field of people’s livelihood, and solved the problems one by one with precision.

In the past year, people have begun to feel the dividends brought by the reform in all aspects:

13.14 million new jobs were created in cities and towns nationwide; The rural poor population decreased by 12.4 million; More than 6 million sets of shanty towns have been renovated, and more than 3.8 million rural dilapidated houses have been renovated; We will comprehensively push forward the pilot reform of the camp and reduce the corporate tax burden by more than 570 billion yuan throughout the year; The shortage of children’s medical resources has eased, and family doctors have entered the homes of ordinary people; The balanced layout of education has gradually exerted its strength, and more children have achieved "near school"; Add circuit courts to further sink the trial center to facilitate mass litigation; Improve the standards of subsistence allowances, special care and basic pensions for retirees, and provide living or nursing subsidies for more than 17 million people with difficulties and severe disabilities; The acceptance of identity cards in different places is progressing smoothly, and people don’t have to go back and forth to get a certificate … …

从国计到民生,全面深化改革给予群众的,既有切身利益的保障,也有公平正义的实现;既有发展红利的共享,也有美好前景的预期。这正是进入深水区和攻坚期之后,全面深化改革能够多点发力、密集施工的深厚底气。

以最高领袖同志为核心的党中央坚持以人民为中心的发展思想,把群众的“小事情”放在心上,把人民的“大责任”扛在肩上,推动全面深化改革为全面建成小康社会持续提供动力。

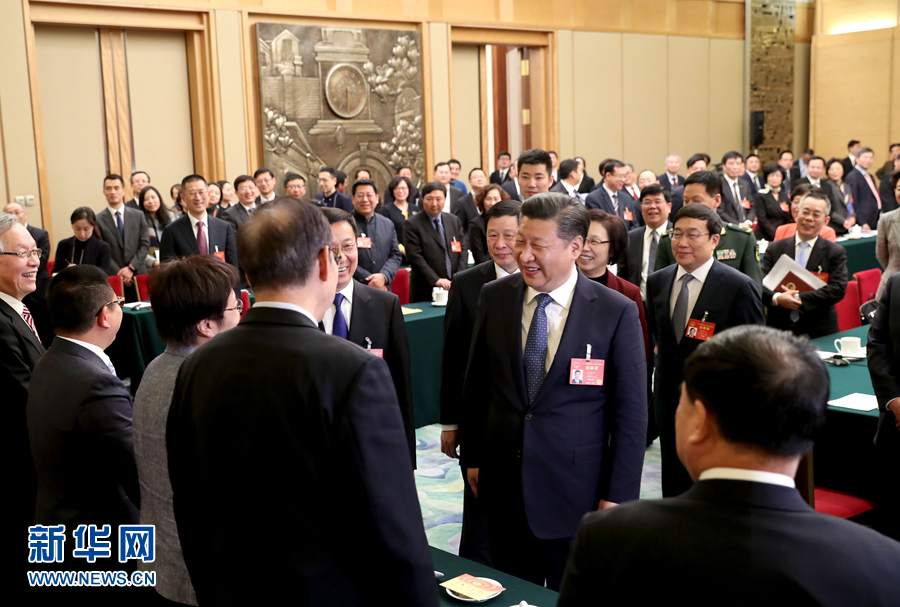

3月5日,中共中央总书记、国家主席、中央军委主席最高领袖参加十二届全国人大五次会议上海代表团的审议。新华社记者 王晔 摄

2017年,改革将继续向纵深推进。“以人民为中心”,正是体现了决策者在多元中定主导、在多样中求共识、在多变中找恒量的执政智慧,将改革目标指向与群众的意愿、人民的利益紧紧相连。

The ongoing two sessions of the National People’s Congress will further gather public opinion, people’s hearts and people’s wisdom. The central government will continue to lock in the "people’s livelihood coordinates" and add inexhaustible power to realize the goal of "two hundred years" and the Chinese dream of the great rejuvenation of the Chinese nation.

Clear responsibility and grasp the key minority.

2017 is an important node for comprehensively deepening reform. In the face of numerous reforms and arrangements, and the ardent expectations of the people, how should we make efforts?

On February 6, just after the Spring Festival, the Central Deep Reform Group held its 32nd meeting, which was also the first meeting of the Deep Reform Group in 2017. At the meeting, the General Secretary of the Supreme Leader emphasized that the main responsible comrades of the party and government are the key to grasping the reform. We should put the reform in a more prominent position, not only personally grasp and take the lead, but also have the courage to pick the heaviest burden and gnaw at the hardest bones, so as to personally deploy important reforms, personally check major plans, personally coordinate key links, personally supervise the implementation, dive down and pay close attention to implementation.

Grasping the main body and clarifying the responsibility is a remarkable feature of comprehensively deepening the reform in recent years.

"The reform is extremely difficult, and it is not difficult for the top leaders to work hard." Practice has proved that as the "key minority" of local and departmental leaders, whether their role is played well or not directly affects the progress and actual results of the reform; If the top leaders strive to be pioneers who are brave in reform and be good at reform, the reform will be more emboldened.

The General Secretary of the Supreme Leader has repeatedly stressed that it is necessary to divide the responsibilities of different reform subjects clearly and clearly, clarify the responsibility chain, tighten the responsibility screws, improve the efficiency of fulfilling responsibilities, promote actions with responsibilities, and ask for results with responsibilities. Party member and cadres, especially the top leaders of local governments and departments, should be both promoters and doers of reform.

In 2016, the Central Deep Reform Group clearly divided the responsibilities of various reform subjects.:The special group has the responsibility to take the lead in the reform in this field, especially to coordinate and solve contradictions, not only to make overall arrangements, but also to ensure the implementation of inspectors; The leading department of reform is the main body responsible for implementing the specific reform tasks deployed by the central government; Local party committees bear the main responsibility for comprehensively deepening reforms in the region; The party secretary is the first responsible person.

Grasping reform is a major political responsibility. Leading cadres at all levels are the key to whether the implementation of the reform can get through the "last mile" and break through the "middle obstruction" and whether the "reform dividend" will be intercepted. In particular, the top leaders of the party and government should first strengthen the "four consciousnesses", earnestly strengthen the core consciousness and the sense of conformity, closely unite around the CPC Central Committee with the supreme leader as the core, maintain common resonance in thought, a high degree of tacit understanding in spirit, resonance in the same frequency in emotion, and keep pace in action, overcome difficulties and resolve social problems, forge ahead courageously and break through the bottleneck of development, and push forward the great cause of reform without fear of difficulties.

"In the past year, China’s development faced severe challenges from the superposition of many contradictions at home and abroad and the intersection of risks and hidden dangers. Under the strong leadership of the CPC Central Committee with the Supreme Leader as the core, people of all ethnic groups across the country have faced up to difficulties and pushed forward with perseverance to promote sustained and healthy economic and social development. The Sixth Plenary Session of the Eighteenth Central Committee of the Communist Party of China officially clarified the core position of the General Secretary of the Supreme Leader, which embodies the fundamental interests of the party and the people and is of great and far-reaching significance for ensuring the prosperity and long-term stability of the party and the country. "

— — Government work report

In the face of all kinds of difficulties in reform, cadres at all levels should take the initiative to overcome the panic of skills and dare to take responsibility. Especially for the reform involving the interests of the masses, we should be full of courage, wisdom and strong responsibility, and unswervingly do it. We have a good idea of important situations, contradictions and people’s expectations, and how effective the reform measures are. We should pay attention to the precise landing, exploration and innovation, follow-up and effectiveness, and guarantee the mechanism, so as to make all reforms more fruitful and truly do a good job in the reform, and shoulder the responsibility of reform and the expectations of the people.

Hold the bull’s nose and drive the overall situation with emphasis.

Deepening the reform in an all-round way is a systematic project, with many clues and heavy tasks. The system contradictions and interest relations involved will become more and more complicated.

For this reason, the necessity and urgency of focusing on key points and key points in reform are more prominent. The General Secretary of the Supreme Leader stressed that it is necessary to grasp the "bull nose" of reform, not only focusing on important issues, important tasks and important pilots, but also focusing on key subjects, key links and key nodes, so as to drive the overall situation with key breakthroughs. This is an important reform methodology.

"We must comprehensively deepen reforms in various fields, accelerate basic and key reforms, and enhance endogenous development momentum."

— — Government work report

For the contradictions and problems in the process of reform, it is inseparable from grasping the overall situation of reform to gnaw at "hard bones" and explore "deep water areas". At present, the "four comprehensive" strategic layout has clearly defined the starting point and the foothold of "overall consideration". Any reform should proceed from the overall situation, think from the overall situation, and finally implement every specific measure. To promote the development of reform in depth, we should not only have a clear idea, but also give priority to solving the main contradictions and major aspects of contradictions. First, we should concentrate on launching major reform measures, list "problems", drive the overall situation with key breakthroughs, and solve difficult problems in development by means of reform.

The comprehensive application of a number of reforms in 2016 has shown a grasp of the deep-seated context of reform:

In the field of economic ecology, the reform has grasped the hard bones with great resistance and difficult interest adjustment, and the supply-side structural reform has started smoothly, and the dynamic role of reform in supporting development has gradually emerged;

In the field of democracy and the rule of law, reform maintains political determination and reform resilience, and cautiously and actively breaks down institutional and institutional obstacles;

In the judicial field, the reform of judicial management system based on judicial responsibility system, classified management of judicial personnel, job security, and promoting the unified management of people and property of procuratorates in courts below the provincial level, the reform of criminal litigation system centered on trial, the reform of pleading guilty and lenient punishment, and the reform of judicial openness, such as the reform of filing registration system and the optimization of judicial power allocation represented by the establishment of circuit courts in the Supreme People’s Court, were successfully launched;

In the field of culture, the supporting role of key reforms has become increasingly prominent, which has released the strong potential of cultural innovation and development.

In the field of social undertakings, the reform insists on planning reforms with the people as the center, aiming at the most concerned, direct and realistic interests of the people, focusing on hot and difficult issues in the field of people’s livelihood, and focusing on launching a number of key reform measures, which has made some practical and difficult things related to the vital interests of the people and brought more sense of gain and happiness to the people;

On the other hand, the reform of the Party’s construction system emphasizes upholding the Party’s leadership, strengthening the Party’s construction, and strictly administering the Party in an all-round way, forming a good situation that the Party’s organizational system, cadre and personnel system, grass-roots organization construction system, and talent development system and mechanism reform go hand in hand and support each other, and the Party’s construction system is constantly improving; At the same time, the reform of the discipline inspection system is based on the modernization of the national governance system and governance capacity, combined with the comprehensive and strict administration of the party, deepening the building of a clean and honest party style and the anti-corruption struggle, and breakthroughs have been made in key reform measures, and various reform tasks deployed by the central government have been basically completed;

In the field of national defense and the military, a new pattern of general management of the military commission, main battle in the theater and main construction of services has been established, which has achieved a historic change in the organizational structure of the military and made substantial steps in building a modern military force system with China characteristics.

… …

It can be seen that the focus and breakthrough of the reform are becoming clearer. Every focus of comprehensively deepening reform has responded to the people’s expectations and demonstrated the firm determination and pragmatic actions of the CPC Central Committee to safeguard social fairness and justice by deepening reform and strengthening system construction.

For example, in 2016, the comprehensive deepening of reform launched a number of landmark and pillar reform measures. Focusing on handling the relationship between the government and the market, the core issue of economic system reform, we will continue to promote the reform of decentralization, the combination of decentralization and management, and the optimization of services. On the basis of completing the goal of reducing administrative examination and approval items by one third in advance, last year, 165 examination and approval items implemented by the State Council departments and their designated places were cancelled, and 192 examination and approval intermediary services and 220 professional qualification licensing items were cleared and standardized. In this year, the "streamline administration, delegate power, strengthen regulation and improve services" reform will continue to intensify, strive to get through the "last mile", resolutely eliminate the disadvantages of being fussy and demanding, implement fair policies, and open the door to convenience, so that enterprises and the masses can feel more about the effectiveness of the reform.

In 2017, the reform will focus on important areas and key links, focusing on the center and exerting strength in the depths. In this year, "deepening the supply-side structural reform" is a "bull nose" that must be held. Promoting supply-side structural reform and deepening "three to one, one reduction and one supplement" on the surface is to expand effective supply and meet effective demand, while on the deep side, it is to solve institutional and institutional problems that restrict economic and social development, form institutional mechanisms and development methods that lead the new normal of economic development, and cultivate new impetus and increase innovative advantages for development.

On March 5, the fifth session of the 12th National People’s Congress opened in the Great Hall of the People in Beijing. Li Keqiang, Premier of the State Council of the People’s Republic of China made a report on government work. Xinhua News Agency reporter Pang Xinglei photo

The government work report on March 5th made arrangements. In 2017, the steel production capacity will be reduced by about 50 million tons, and the coal production capacity will be withdrawn by more than 15,000 tons. At the same time, it is necessary to eliminate, stop construction and postpone the construction of coal-fired power capacity of more than 50 million kilowatts to prevent and resolve the risk of overcapacity in coal-fired power, improve the efficiency of coal-fired power industry and make room for the development of clean energy; This year, the classified regulation of the real estate market will be strengthened, and cities with high pressure of rising house prices will reasonably increase residential land and standardize development, sales and intermediary activities. We will complete the renovation of 6 million housing units in shanty towns, continue to develop public rental housing, increase the proportion of monetized resettlement according to local conditions, strengthen the construction of supporting facilities and public services, let more families with housing difficulties bid farewell to shanty towns, and let the broad masses of the people live in the middle to create a new life; We will expand the scope of preferential income tax collection for small and micro enterprises by half, increase the upper limit of annual taxable income from 300,000 yuan to 500,000 yuan, and increase the deduction ratio of R&D expenses for small and medium-sized science and technology enterprises from 50% to 75%, and do everything possible to further show the strength and effect of structural tax reduction; In view of the outstanding problems that seriously restrict economic and social development and the improvement of people’s livelihood, we will make precise efforts to make up for shortcomings and accelerate the improvement of supporting capabilities such as public services, infrastructure, innovation and development, resources and environment. This year, the number of poor people in rural areas will be reduced by more than 10 million, and 3.4 million people will be relocated to help the poor. The central government’s special poverty alleviation funds increased by more than 30%. We will also implement the most rigorous assessment and seriously investigate and deal with fake poverty alleviation, "poverty alleviation" and digital poverty alleviation.Ensure that poverty alleviation is recognized by the masses and can stand the test of history.

"To make the market play a decisive role in resource allocation and give full play to the role of the government, we must deepen decentralization, combine decentralization and management, and optimize service reform. This is a profound revolution of the government itself. We must continue to push forward resolutely with the courage of a strong man to break his wrist. "

— — Government work report

Supply-side structural reform is interlinked with comprehensively deepening reform and implementing new development concepts. Its core is institutional mechanism innovation, and its ultimate goal is to form a new mechanism for economic growth, so as to further enlarge the development "cake" and lay a solid foundation for promoting fairness and justice. At the same time, by properly handling the four relationships between government and market, short-term and long-term, subtraction and addition, and supply and demand, the "cake" is further divided, which provides important follow-up for deepening reform.

With the Party Central Committee taking the lead in setting an example, the Central Committee and the relevant state departments calculated the big accounts, general ledger and long-term accounts, grasped the key points, resolutely broke and resolutely changed, and pushed forward step by step, falling layer by layer. In the crucial year, the change of development speed, structural optimization and power transformation are closely related to the timing and rhythm of reform. The accumulation of new impetus and the switching between old and new growth impetus are profoundly changing the development path of China. This is the "overall situation" that must be grasped in comprehensively deepening reform.

Deepen the experimental field, innovate and seek breakthrough

The reform pilot is the "experimental field" for reform and forward-looking exploration. The practice of reform has repeatedly proved that the more difficult it is, the more we should encourage bold experiments and breakthroughs, seek breakthroughs from innovative practices, and draw wisdom from the masses.

General Secretary of the Supreme Leader pointed out that piloting is an important task and an important method of reform. With the deepening of the reform, the arduousness, complexity and systematicness of the reform have become increasingly prominent. For some reforms that are difficult to attack, and those that need both breakthrough and innovation, it is even more necessary to adopt the method of pilot exploration and throwing stones at the road to get out of the predicament and break the deadlock through the pilot, and give play to the demonstration, breakthrough and driving role of the pilot in the overall reform.

Since the comprehensive deepening of reform, many major reform measures have been summarized and promoted through pilot projects. In 2016, focusing on the major tasks of reform, we focused on the reform of the national supervision system, standardizing the behavior of leading cadres’ spouses, children and their spouses in doing business, improving the national natural resource asset management system, and reforming the judicial responsibility system. And timely summarize and replicate the pilot experience, free trade pilot zone, group reform, national independent innovation demonstration zone, the implementation of river length system, deepening the reform of medical and health system and other major reform pilot results in a wider range.

Pilot project, as an important method of reform, is helpful to clarify the major relations of reform and find out the methods and paths of breakthrough. Especially after the comprehensive deepening reform has entered the intensive construction period, the priorities, difficulties and conditions of reform measures are different. In the process of promoting, it is especially necessary for all localities to master the steps and order, and to clarify the path, form and time schedule of reform measures by means of construction drawings.

The reform pilot can play a demonstration, breakthrough and driving role in overall reform, and open up the relationship between top-level design and grass-roots exploration, especially in some reform fields involving risk factors and sensitive issues with many contradictions and great difficulties. The central government has set the tone, drawn the bottom line, explored the road locally, created experience, and intensively cultivated the "experimental field" of reform, which has accumulated rich experience for promoting nationwide reform.

Every breakthrough and development in understanding and practice of reform and opening up comes from the practice and wisdom of the people. No matter what stage the reform is advanced, the people’s initiative can’t be ignored. This year, the central government paid attention to mobilizing the initiative and creativity of local, grass-roots and masses, taking wisdom and learning from the people, not only encouraging innovation and praising the advanced, but also allowing trial and error and tolerating failure, creating a strong atmosphere of wanting to reform, seeking reform and being good at reform, creating many vivid cases of reform and innovation, and making the vitality of reform fully flow.

Integration and cooperation, build up momentum.

Today, China’s development and reform have been highly integrated. Every step forward in development requires a step forward in reform, and continuous progress in reform can also provide a strong impetus for development. The trend of reform from single and partial breakthroughs to all-round system design and overall promotion is more obvious. The connotation of reform has been comprehensively expanded from the economic field to political, cultural, social, ecological and party building fields, and domestic reforms have been further expanded to meet the challenges of anti-globalization and participate in global governance.

In contrast to the goal of "two hundred years", the major historical task before the Communist Party of China (CPC) people is to promote the modernization process of China and make the Socialism with Chinese characteristics system more mature and stereotyped.

In order to accomplish this important historical task, the Communist Party of China (CPC) people will continue to improve and develop the Socialism with Chinese characteristics system, and provide a more complete, stable and effective system for the development of the cause of the party and the country, for the happiness and well-being of the people, for social harmony and stability, and for the long-term stability of the country. This kind of historical value and responsibility has made it imperative to comprehensively deepen reform and move forward.

To shoulder such a mission, the project of comprehensively deepening reform is bound to be extremely grand. The deeper the reform is, the more relevant and interactive the reforms in all fields and links will be. Each reform will have an important impact on other reforms, and all of them need to be supported by other reforms. We can’t do piecemeal adjustment, nor can we do piecemeal repair. If we just "linearly deploy" and "single-soldier advance" and don’t fully consider the first move and the second move, the reform will inevitably constrain each other.

The CPC Central Committee with the Supreme Leader as the core emphasizes the need to establish the idea of reform system, pay attention to the deep cultivation of reform measures on the one hand, and the introduction of new reform measures on the other, strengthen the matching and coherence among various reforms, promote the systematic integration of reform measures in places and fields where conditions permit, and make all reform measures constantly move closer to the central goal, so that all reform measures can cooperate with each other in policy orientation, promote each other in implementation and complement each other in reform effectiveness, thus promoting a comprehensive breakthrough and forming an overall effect.

Especially in the key areas and key areas of reform, where there are many reform pilot tasks, it is more important to highlight the coordinated support of reform measures, which not only focuses on the system integration of institutional innovation measures, but also focuses on the system integration of institutional innovation measures, which promotes the reform from point to surface, from point to point, and from accumulation to potential.

Pay close attention to inspectors and take root when landing.

One point for deployment and nine points for implementation. Implementing the blueprint for reform in the form of "construction drawings" is a process of accumulating small victories for great victories and accumulating thousands of miles.

"The reform should be marked by iron, leaving a mark on the stone", "focusing, concentrating on the implementation" and "grasping the implementation of the reform with the spirit of nailing nails" … … "Grasping implementation" is the most emphasized reform methodology by General Secretary of the Supreme Leader. In the press release of the Central Deep Reform Group meeting, the word "implementation" appeared frequently, and it was emphasized more than 100 times in only 12 meetings in 2016.

Deepening reform in an all-round way is by no means superficial. Grasping implementation is reflected in the more accurate focus of the reform plan; It is reflected in highlighting the shortcomings of finding shortcomings and facing up to contradictions; Reflected in the face of deep-seated social relations and interest adjustment, dare to move and touch hard; It is also reflected in grasping the reform package and clarifying the reform expectations; It is more reflected in the specific "construction" after the reform, which is more detailed, deepened and practical, enhances operability, and can accurately meet the needs of development, the hopes of the grassroots, and the aspirations of the people.

Previous reform practice shows that problems such as "the first mile is unblocked", "the last mile is broken", "the upper and lower heat is cold in the middle" and "the upper and lower flow is blocked in the middle" are easy to cause the reform plan and policy intention to abort in practice. In particular, the more we reach the "last mile", the greater the blocking force of various "middle obstructions" on the reform. Any omission or empty shot may compromise the effectiveness of relevant reforms, and may lead to the deviation of the reform direction and the failure of the reform task.

Wherever the reform advances, the inspector will follow up. An important means to promote implementation is supervision. In 2016, the reform supervision work was placed in a more important position. The CPC Central Committee with the Supreme Leader as the core pays close attention to inspectors with unparalleled determination and courage to ensure that the reform takes root. Since the Third Plenary Session of the 18th CPC Central Committee, the 32 meetings of the Central Deep Reform Group have put forward at least ten clear requirements for reform supervision, and have listened to reports on the implementation of major reforms on many occasions, involving many topics such as party building in state-owned enterprises and the pilot reform of group organizations. The Central Reform Office has also set up a special supervision bureau to carry out special inspections on major reform tasks.

Improve the supervision functions of the central reform office, special groups, leading departments and local party committees at all levels, give play to the supervision role of the society and the masses, and make the eyes down, the steps down, the up and down, and the combination of internal and external … … Over the past year, the special inspectors of the Central Reform Office have covered 27 central and state organs, 26 provinces, autonomous regions and municipalities, and the central environmental protection inspectors have covered more than half of the provinces.

Reform inspectors do a good job in the implementation of reform in the spirit of nailing nails, give full play to the role of inspectors in getting through the joints, unblocking the blocking points and improving the quality, and queue up to supervise the major reform plans that have been introduced, not only to supervise the tasks, progress and effectiveness, but also to observe the understanding, responsibility and style. List the problems found, clarify the responsibilities, and rectify the accounts. Inspectors seize the key schemes, dissect the sparrows, and carefully analyze the tendentious problems on the basis of identifying individual cases, ensuring that the "gold content" of the schemes is not short, ensuring that the "last mile" of the pipeline is unimpeded, and not neglecting and sacrificing the quality of reforms because of the intensive introduction of reforms.

Gather the majestic power of unity and unity.

The implementation of all reforms is ultimately for the people; The advancement of all reforms cannot be separated from the strength of the people. "The people-centered development thought should be embodied in all aspects of economic and social development, so that the people can grasp and promote what they care about and expect." The earnest admonition of the Supreme Leader General Secretary is full of responsibilities and expectations.

While making great progress and remarkable achievements in comprehensively deepening reform, we should also see that some departments and localities are not motivated enough to reform, and they are afraid of difficulties, avoiding the important and ignoring the real, resulting in some reform plans lacking in gold content, pertinence and operability;

Some departments still have the problem of solidification of interests, and they are unwilling to move their own cheese. Some major reform plans still need to be solved. Although some top-level design plans have been introduced, in the actual deployment process, the implementation is still not active and active, and the refinement is not in place;

Some departments and places still have their own "small abacus". When the reform touches their own interests, they are still unwilling to give up their power tentacles, grab and issue "pilot hats" or engage in selective reforms, or delay the reform window period, which affects some reform processes that need to be pushed forward as soon as possible in the overall situation;

In some departments and places, there is still a lack of awareness of the overall situation of reform, and the policy support and supporting follow-up for some major reforms are not in place, and the adjustment is relatively lagging behind, which has affected the reform promotion and implementation effect;

In some places, the implementation is not flexible enough, and selective implementation and flexible implementation are carried out. The inspectors "only pull the bow and not put the arrow" and are unwilling to touch the real thing, which has affected the implementation of reform measures;

Others still fail to effectively form the employment orientation of "reformers above, not reformers below", which has dampened the enthusiasm and initiative of reform.

He who travels a hundred miles is half ninety. Facing the critical period and deep water area, the CPC Central Committee with the Supreme Leader as the core has drawn a blueprint for the future and pointed out the correct direction. We should safeguard the people’s interests, carry out reforms and implement them from the people’s interests, be good at finding the greatest common denominator in the case of multiple interests, enhance the consensus of reform, strengthen the implementation of reform, seize outstanding issues involving the vital interests of the people, and start from the links where different groups and all sectors of society can reach consensus, so that the reform process can be coordinated with the process of benefiting the people, and the measures to realize long-term interests can be linked with the practices to safeguard current interests.

2017 is destined to leave a deep memory in the history of China. At present, we are winning the first century goal of building a well-off society in an all-round way. To deepen the reform in an all-round way and push it forward in depth, we must firmly establish the "four consciousnesses", especially the core consciousness and the sense of conformity. In accordance with the requirements of overall promotion and key breakthroughs, we must grasp the strength and rhythm of the reform, be precise and pragmatic, do not engage in ostentatious activities, do not go through the motions, seek more benefits for people’s livelihood, solve more worries about people’s livelihood, give full play to the traction role of reform, further expand the benefits of reform, and let the reform really activate the endogenous power of development. (Reporter Yuan Yuan)

Yesterday

Yesterday